sales tax everett wa 2021

Save money on one of 12 used 2021 Ferraris in Everett WA. The Washington sales tax rate is currently.

Deal Ends Legal Fight And Allows Tulalips A Cut Of Sales Tax Heraldnet Com

The current total local sales tax rate in Everett WA is 9800.

. The everett sales tax is collected by the merchant on all qualifying sales made within everett. Local tax rates in Washington range from 0 to 39 making the sales tax range in Washington 65 to 104. Select the Washington city from the list of.

Businesses making retail sales in Washington collect sales tax from their customer. Search by address zip plus four or use the map to find the rate for a specific location. This is multiplied by your gross receipts to compute your taxes due.

Just tap to find the rate Local sales use tax. Youll find rates for sales and use tax motor vehicle taxes and lodging tax. Did South Dakota v.

The County sales tax rate is. The Everett Sales Tax is collected by the merchant on all qualifying sales made within Everett. The minimum combined 2022 sales tax rate for Everett Massachusetts is.

To calculate sales and use tax only. Wayfair Inc affect Washington. Chrome Chrome Step Bars Class IV Trailer.

Everett WA 98201 Excellent investment or redevelopment opportunity near the proposed Light Rail expansion terminal and existing Amtrac station. Sales tax On January 1st 2021 the retail sales tax in King County was raised to 101 in most cities. Look up a tax rate.

4205 019 065084 Everson. Tax Rates Effective April 1 - June 30 2021 Note. ZIP--ZIP code is required but the 4 is optional.

The Everett sales tax rate is. Business and Occupation Tax Rate. The 98 sales tax rate in Everett consists of 65 Washington state sales tax and 33 Everett tax.

The County sales tax rate is. A retail sale is the sale of tangible personal property. The 99 sales tax rate in Everett consists of 65 Washington state sales tax and 34 Everett tax.

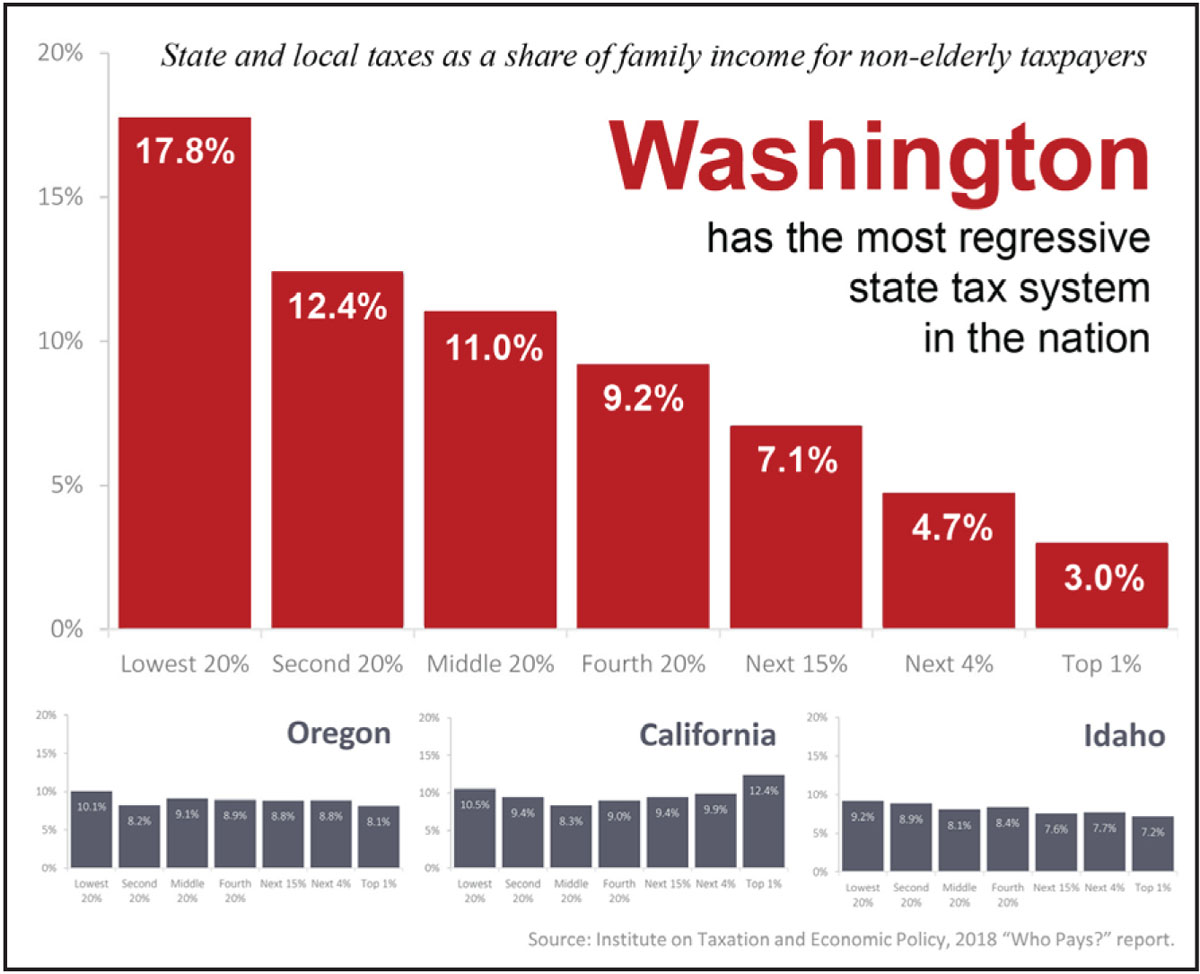

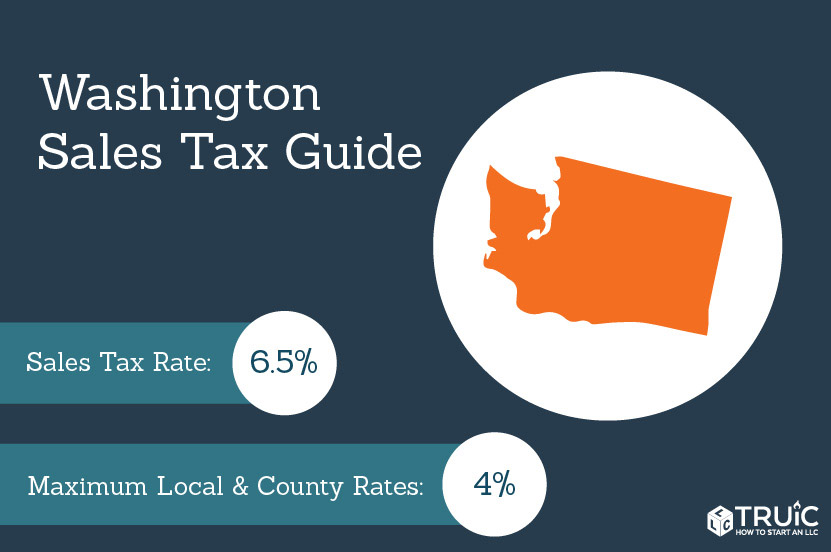

Local tax rates in Washington range from 0 to 39 making the sales tax range in Washington 65 to 104. This is the total of state county and city sales tax rates. With local taxes the total sales tax rate is between 7000 and 10500.

8 beds 2 baths 3038 sq. Location SalesUse Tax CountyCity Loc. Groceries are exempt from the Everett and Washington state sales taxes.

The bulk of this revenue goes to the state and our Regional Transit Authority RTA Sound Transit. Rate variation Click here for a larger sales tax map or here for a sales tax table. The Everett sales tax rate is.

ICalculator US Excellent Free Online Calculators for Personal and Business use. Average Sales Tax With Local. 3506 Rockefeller Ave Everett WA 98201 850000 MLS 1930007 Compare to new Construction.

In a 3-2 vote the Snohomish County Council passed an ordinance that will add one tenth of one percent to the sales tax to fund additional housing and mental. Use this search tool to look up sales tax rates for any location in Washington. Did South Dakota v.

Tax rates are updated quarterly. Local tax rates in Washington range from 0 to 39 making the sales tax range in Washington 65 to 104. Washington has recent rate changes Thu Jul 01 2021.

What is the sales tax rate in Everett Massachusetts. Priced below KBB Fair Purchase Price. The County sales tax rate is.

Everett in Washington has a tax rate of 97 for 2022 this includes the Washington Sales Tax Rate of 65 and Local Sales Tax Rates in Everett totaling 32. Washington sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Washington has state sales tax of 65 and allows local governments to collect a local option sales tax of up to 31.

The Everett Washington sales tax is 970 consisting of 650 Washington state sales tax and 320 Everett local sales taxesThe local sales tax consists of a 320 city sales tax. Penalties and interest are due if tax forms are not filed and taxes are not paid by the due date. This is the total of state county and city sales tax rates.

The present tax rate is 01 0001. There are a total of 105 local tax jurisdictions across. For example for a taxable gross revenue amount of.

Retail Sales and Use Tax. The Sales and Use Tax is Washingtons principal revenue source. Code Local Rate State Rate Combined.

Salary ranges can vary widely depending on many important factors including education certifications additional skills the number of years you have spent in your profession. What is the sales tax rate in Everett Massachusetts. December 15 2021.

To calculate sales and use tax only. Home had a studs out remodel in 2021. That the value used to calculate your portion of your 2021 property tax bill was an estimate of what your property could sell for on january 1st 2020.

For tax rates in other cities see Washington sales taxes by city and county. Find your Washington combined state and local tax rate. Washington has recent rate changes Thu Jul 01 2021.

The December 2020 total local sales tax rate was also 9800. 100000 the business pays 100. The minimum combined 2022 sales tax rate for Everett Washington is.

The average Sales Tax Accountant salary in Everett WA is 57672 as of June 28 2021 but the salary range typically falls between 50239 and 65054. You can print a 99 sales tax table here. The Everett Washington sales tax is 970 consisting of 650 Washington state sales tax and 320 Everett local sales taxesThe local sales tax consists of a 320 city sales tax.

As of 2019 Snohomish County would need 127215 additional units of housing by 2040approximately 6300 new units each yearfor no household in Snohomish County to spend more than 30 of their. There is no applicable county tax or special tax. Total 77 103.

Find your Washington combined state and local tax rate. Taxable sales The Washington State DOR maintains a detailed and useful online database of taxable sales and sales tax distributions. This is the total of state county and city sales tax rates.

It is comprised of a state component at 65 and a local component at 12 38. Decimal degrees between 450 and 49005 Longitude. The Massachusetts sales tax rate is currently.

What is the sales tax rate in Everett Washington. Use our Tax Rate Lookup Tool to find tax rates and location codes for any location in Washington. For footnote information please see the bottom of page 5.

Condo located at 2020 130th pl sw everett wa 98204. 31 rows The state sales tax rate in Washington is 6500. The Everett sales tax rate is.

Assessor Typical 2021 Homeowner Tax Bill Akin To Last Year S Heraldnet Com

Washington State Sales Tax Rate Usgeocoder Blog

Assessor Typical 2021 Homeowner Tax Bill Akin To Last Year S Heraldnet Com

The Kind Of Change We Need Senate Oks Capital Gains Tax The Stand The Stand

Washington Sales Tax Rates By City County 2022

Washington State Sales Tax Rate Usgeocoder Blog

Assessor Typical 2021 Homeowner Tax Bill Akin To Last Year S Heraldnet Com

Washington Sales Tax Small Business Guide Truic

Washington State Sales Tax Rate Usgeocoder Blog

Washington State Sales Tax Rate Usgeocoder Blog

Washington State Sales Tax Rate Usgeocoder Blog

Washington Sales Tax Guide For Businesses

Pros And Cons Of Living In Everett Wa Cheap Movers Seattle

Washington State Sales Tax Rate Usgeocoder Blog

Washington State Sales Tax Rate Usgeocoder Blog

Snohomish County Residents Brace For 0 1 Sales Tax Increase April 1 Lynnwood Times

/https://s3.amazonaws.com/lmbucket0/media/business/132nd-street-se-seattle-hill-road-207D-1-6wYYVYYwpzMresTG8aRB50iNJokxq5bZ8dUru7Ffdl4.3b02973cb170.jpg)